36+ Obamacare Cadillac Tax 2018

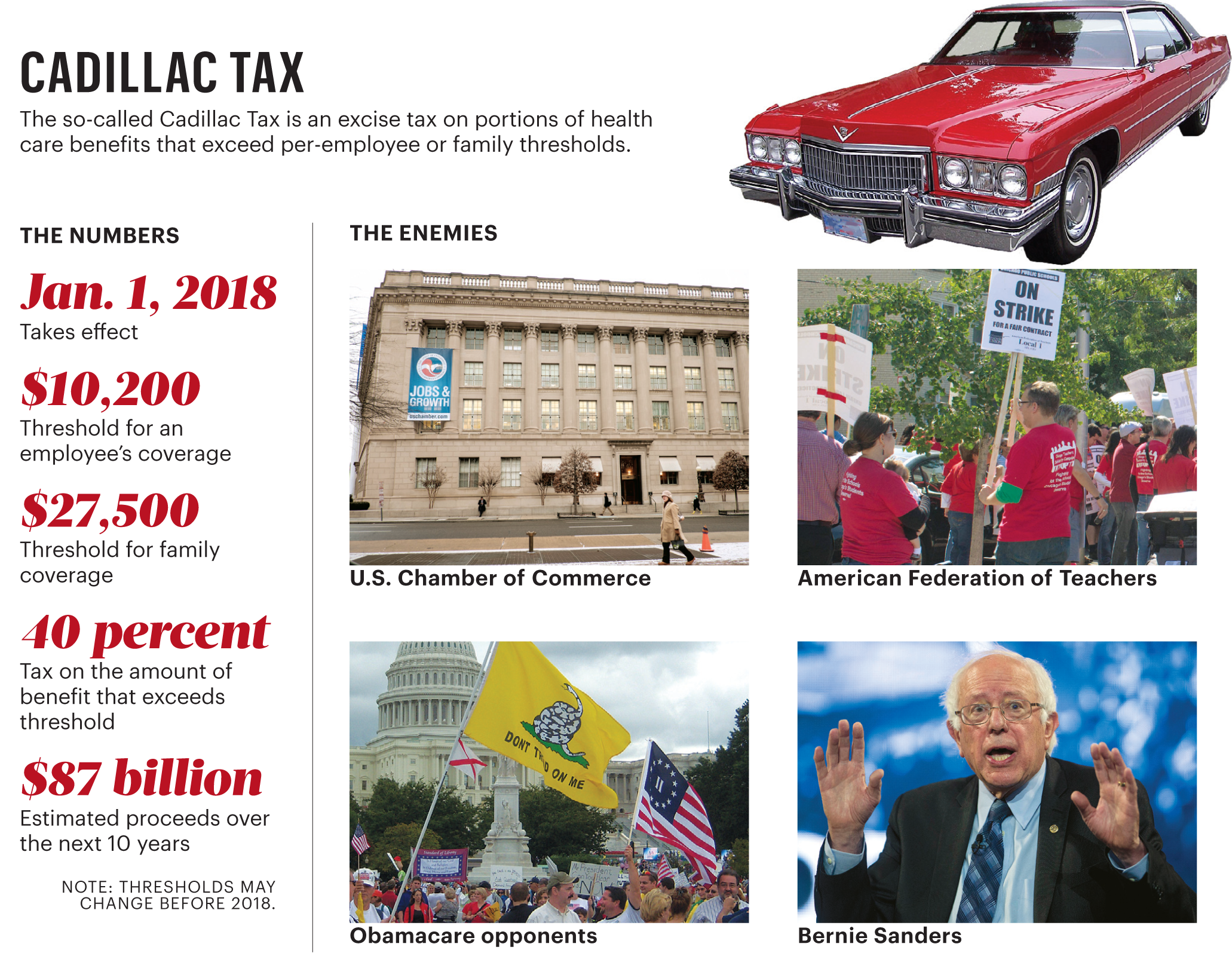

Images. Obamacare's cadillac tax is a 40% excise tax on high end plans above $10,200 for individuals and $27,500 for family coverage that was set to start in 2018 but was been delayed. The cadillac tax was created as part of the affordable care act largely as a way to help fund benefits to the uninsured under the law.

In fact, the obamacare repeal bill that the house ways. The best way to get the best deal on a new 2018 obamacare cadillac tax involves doing plenty of diligent research on makes, models levels of equipment and prices. Reduce overall health care costs;

That money will partly offset the cost of the the expansions of medicaid and democrats aren't the only ones calling to eliminate the cadillac tax.

This provision will impose a 40 percent tax on the cost of individual health plans above $10,200 for individuals and $27,500 for family coverage, with both employer and worker contributions included. Tax.9 the tax is intended to do three things: The house voted almost unanimously. In 2018, the cadillac tax portion of obamacare goes into effect.